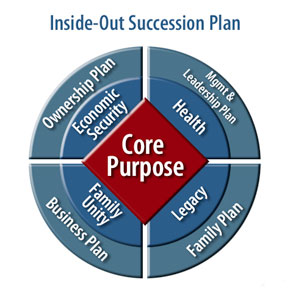

Understanding the Four PlansPart 1 of this article highlights what typically motivates an owner-entrepreneur to plan for succession and how to begin that process. Here, we'll focus on four different, but interrelated, plans or processes that should be drawn into a complete succession plan. Three of the four plans are direct for the business: the ownership plan, the management and leadership plan, and the business plan. The fourth, the family plan, defines how the family can be a family without the undue influence of the business.

All the plans here are driven by the entrepreneur's core purpose that motivates the reason for the succession. Let's look briefly at each of them.

Ownership

As I stated previously in Part 1, ownership plans should consider more than how to save taxes. Ownership succession (ranked by priority) includes estate planning, economic security, equitable treatment of adult children, and then minimizing estate taxes.

All the plans here are driven by the entrepreneur's core purpose that motivates the reason for the succession. Let's look briefly at each of them.

Ownership

As I stated previously in Part 1, ownership plans should consider more than how to save taxes. Ownership succession (ranked by priority) includes estate planning, economic security, equitable treatment of adult children, and then minimizing estate taxes.

An ownership plan must reflect the entrepreneur's core purpose. Estate planning is part of that ownership. At its basis, the entrepreneur needs to discuss his or her core purpose and to determine if another generation of the family wants to, or even should, own and operate the family business. If this is not discussed and decided, huge complications can arise when adult children do not want to continue in the business or, the reverse, the founder realizes that no one else in the family is currently capable of operating the business.

The ownership plan must include economic security for the senior generation. No succession plan can succeed unless the senior generation's economic security can be guaranteed.

Equitable treatment of the adult children is also a key consideration of ownership planning. This can include emotional and complicated considerations, especially when there are adult children who are not active in the business or when the family business is the parents' major asset. As a result, equitable treatment among children requires sophisticated technical planning and delicate discussions within the entire family. As technical professionals, it is our responsibility to encourage suggestions from everyone in the family. The entrepreneurial parents should be given this feedback before any estate plan is finalized.

Minimizing estate taxes becomes important only when it's understood who will operate the business, how economic security for the senior generation can be guaranteed and how adult children can be equitably treated. Technical professionals can do some of their best work for the company and family when they include the family in the process.

An ownership and estate plan also includes directions concerning governance. All family businesses are legally required to have a board of directors. Generally, most boards are inactive and meet only on an annual basis in order to fulfill legal requirements. When only the entrepreneur is involved in the business, an annual meeting may work fine. However, when many family members are involved in the business, it is imperative to have an active board of directors that includes outside advisors and members.

Ernesto Poza writes in his book Family Business (3rd ed.) that family businesses with active boards and outside advisors are more successful than those that don't have these structures in place. When the entrepreneur is succeeded, an active board of directors (or at least outside, expert advisors) is vital to helping develop a new or at least future-forward system.

I have worked with many advisory boards and have seen how they can soften the relationship between an entrepreneur and a son or daughter. Instead of reporting to a parent,adult children are reporting to a board that facilitates the parent-child relationship.

Management and Leadership

There are several components of a management and leadership plan:

Outside resources such as the Strozzi Institute's Leadership in Action 1 and 2 workshops can be very helpful at this stage. Our Hubler for Business Families firm regularly mentors the next generation when they return. We help them integrate into their work what they learned about leadership at the Strozzi Institute.

Finally, compensation and decision-making are two of the more difficult issues facing family-owned businesses. These issues are qualitative as well as quantitative, and they are instinctive as well as measurable, which can make them difficult to discuss unemotionally. Thus, putting structure and formality into these areas is vital for both the family and the business.

Business

A formal business plan is essential when more than one family member works in the business. I often use an online resource with clients such as the PerfectBizMatch survey to begin the strategic planning discussion. I have each family member complete the survey, which gives us an assessment of their perspectives about the company. Then, the family group meets to discuss their individual scores strategically and begins the business planning process.

Business plans are like fingerprints; no two are alike. But more than personally identified, they are also necessary for and descriptive of each business.

Family

I believe so strongly in including the family in the process that I make it one of the four plans that constitute the Inside-Out Succession Plan model. The entrepreneur and the entire family must carefully consider and discuss how to limit the impact of the business on family relations.

While teaching the Family Business Management class at the University of St. Thomas (Minneapolis), I told students, "Normal, even 'natural' business and financial differences will erode family relationships - it is just a matter of time." That is why it is so critical for family businesses to build the emotional equity of their families just as they build the financial equity of their businesses. Many family businesses pour all their resources - time, energy, money, even devotion - into the business at the expense of their families.

This is why I encourage clients to hold regular family meetings. For large family businesses, I suggest a family council. These family meetings help nurture the emotional equity of the family. They also help manage the boundary between business and family.

Another way to build emotional equity is by actively maintaining and renewing family rituals and traditions. The values of the family are a central part of any successful family-owned business. These values must be celebrated and kept alive through regular family activities. Regular lunches, parent and adult child trips, community service where family members work together, family participation in nonprofit activities - these are a few of many ways that build a family's emotional equity. Research has proven that activities that produce family harmony have a positive impact on the family's business bottom line (Family Business, 3rded.).

Put It All Together

Think of the Inside-Out Succession Plan model as a kind of succession-planning "combination lock." The motivations spin around the core purpose to help the entrepreneur dial direction into succession plan thinking. Then the entrepreneur aligns his or her core motivators to each of the four planning processes to lock in a truly successful outcome. The succession plan is secure when all the tumblers lineup to the benefit, interests and capabilities of everyone in the family and across the business.

Granted, that's no small challenge. But it is certainly attainable and worth doing for the good of the business and the joy of the family.

If you enjoyed this article please consider leaving a comment below, sharing it and/or subscribing to have future articles delivered to your RSS feed reader.

The ownership plan must include economic security for the senior generation. No succession plan can succeed unless the senior generation's economic security can be guaranteed.

Equitable treatment of the adult children is also a key consideration of ownership planning. This can include emotional and complicated considerations, especially when there are adult children who are not active in the business or when the family business is the parents' major asset. As a result, equitable treatment among children requires sophisticated technical planning and delicate discussions within the entire family. As technical professionals, it is our responsibility to encourage suggestions from everyone in the family. The entrepreneurial parents should be given this feedback before any estate plan is finalized.

Minimizing estate taxes becomes important only when it's understood who will operate the business, how economic security for the senior generation can be guaranteed and how adult children can be equitably treated. Technical professionals can do some of their best work for the company and family when they include the family in the process.

An ownership and estate plan also includes directions concerning governance. All family businesses are legally required to have a board of directors. Generally, most boards are inactive and meet only on an annual basis in order to fulfill legal requirements. When only the entrepreneur is involved in the business, an annual meeting may work fine. However, when many family members are involved in the business, it is imperative to have an active board of directors that includes outside advisors and members.

Ernesto Poza writes in his book Family Business (3rd ed.) that family businesses with active boards and outside advisors are more successful than those that don't have these structures in place. When the entrepreneur is succeeded, an active board of directors (or at least outside, expert advisors) is vital to helping develop a new or at least future-forward system.

I have worked with many advisory boards and have seen how they can soften the relationship between an entrepreneur and a son or daughter. Instead of reporting to a parent,adult children are reporting to a board that facilitates the parent-child relationship.

Management and Leadership

There are several components of a management and leadership plan:

- Career plan for the owner-entrepreneur

- Career and leadership plan for the next generation

- Clear decision-making

- Family participation plan and code of conduct

- Compensation arrangements

Outside resources such as the Strozzi Institute's Leadership in Action 1 and 2 workshops can be very helpful at this stage. Our Hubler for Business Families firm regularly mentors the next generation when they return. We help them integrate into their work what they learned about leadership at the Strozzi Institute.

Finally, compensation and decision-making are two of the more difficult issues facing family-owned businesses. These issues are qualitative as well as quantitative, and they are instinctive as well as measurable, which can make them difficult to discuss unemotionally. Thus, putting structure and formality into these areas is vital for both the family and the business.

Business

A formal business plan is essential when more than one family member works in the business. I often use an online resource with clients such as the PerfectBizMatch survey to begin the strategic planning discussion. I have each family member complete the survey, which gives us an assessment of their perspectives about the company. Then, the family group meets to discuss their individual scores strategically and begins the business planning process.

Business plans are like fingerprints; no two are alike. But more than personally identified, they are also necessary for and descriptive of each business.

Family

I believe so strongly in including the family in the process that I make it one of the four plans that constitute the Inside-Out Succession Plan model. The entrepreneur and the entire family must carefully consider and discuss how to limit the impact of the business on family relations.

While teaching the Family Business Management class at the University of St. Thomas (Minneapolis), I told students, "Normal, even 'natural' business and financial differences will erode family relationships - it is just a matter of time." That is why it is so critical for family businesses to build the emotional equity of their families just as they build the financial equity of their businesses. Many family businesses pour all their resources - time, energy, money, even devotion - into the business at the expense of their families.

This is why I encourage clients to hold regular family meetings. For large family businesses, I suggest a family council. These family meetings help nurture the emotional equity of the family. They also help manage the boundary between business and family.

Another way to build emotional equity is by actively maintaining and renewing family rituals and traditions. The values of the family are a central part of any successful family-owned business. These values must be celebrated and kept alive through regular family activities. Regular lunches, parent and adult child trips, community service where family members work together, family participation in nonprofit activities - these are a few of many ways that build a family's emotional equity. Research has proven that activities that produce family harmony have a positive impact on the family's business bottom line (Family Business, 3rded.).

Put It All Together

Think of the Inside-Out Succession Plan model as a kind of succession-planning "combination lock." The motivations spin around the core purpose to help the entrepreneur dial direction into succession plan thinking. Then the entrepreneur aligns his or her core motivators to each of the four planning processes to lock in a truly successful outcome. The succession plan is secure when all the tumblers lineup to the benefit, interests and capabilities of everyone in the family and across the business.

Granted, that's no small challenge. But it is certainly attainable and worth doing for the good of the business and the joy of the family.

If you enjoyed this article please consider leaving a comment below, sharing it and/or subscribing to have future articles delivered to your RSS feed reader.

RSS Feed

RSS Feed